Hansen Natural Part III--Looking for Re-entry

With its huge run-up and the horrible market action today, Hansen Natural (HANS) was ripe for a bout of profit-taking. I got stopped out on half my position early at $190.90, and it closed near the day's low at $184.29, down $16.77. Now the question is when to get back in. My iconoclastic take on this is that determining "fair value" or what the stock "should" trade at is a total waste of time. Stocks trade at whatever price someone will buy them, and that price is determined by people with emotions--by market psychology. Since I don't have the resources to find and poll a representative sample of people trading Hansen stock, the next best thing is to look at the charts.

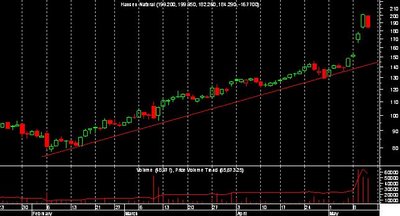

The daily chart above shows a trendline for the last four months, during which time holding Hansen was relatively stress-free. Then massive volatility and a flood of hot money struck (note the volume spike in the lower window). Future charts will give us a clue where that hot money is going. If it all leaves, it will bring the stock back down to the trendline at about $150. That would be a strong buy signal for me. If sellers take control and push it significantly below the trendline I'd consider that a sign of serious trouble and would think about abandoning this stock entirely.

Fundamental analysts typically look at chart reading and technical analysis as the stock-market equivalent of reading tea leaves, a superstitious waste of time. Iconoclasts look at charts as the best clue available to read market psychology, which is the ultimate mover of stock prices.

0 Comments:

Post a Comment

<< Home